FPO stands for Follow-on Public Offer, which is a type of public offering in the stock market where a company that is already listed on a stock exchange issues additional shares to raise capital. Companies often use FPOs to finance their expansion plans, pay off debts, or provide liquidity to existing shareholders. The shares are usually sold to institutional investors and the public, and the price is determined through a bidding process.

In an FPO, the existing shareholders of a company can either sell their shares to new investors or they can choose to retain their shares and continue to hold them. The company issuing the FPO usually hires investment banks to underwrite the offering and act as intermediaries between the company and potential investors. The investment banks ensure that the process runs smoothly and that the shares are sold at a fair price.

The pricing of the FPO is usually determined through a book-building process, where interested investors place bids for the shares they want to purchase. The bids are collected over a period of time, usually, a few days and the final price is determined based on the demand for the shares. The final price is typically lower than the market price of the company's shares since the company is issuing new shares, which dilutes the value of existing shares.

FPOs can be beneficial for companies as they provide a way to raise capital without incurring debt, and they can also increase the visibility and liquidity of the company's shares. However, FPOs can also have negative effects, such as a decrease in the value of existing shares due to dilution and the possibility of a lower demand for the shares if the market conditions are unfavourable.

Overall, FPOs are a common way for companies to raise capital in the stock market, and they provide an opportunity for investors to participate in the growth of a company by buying its shares.

Why did Adani withdraw its FPO?

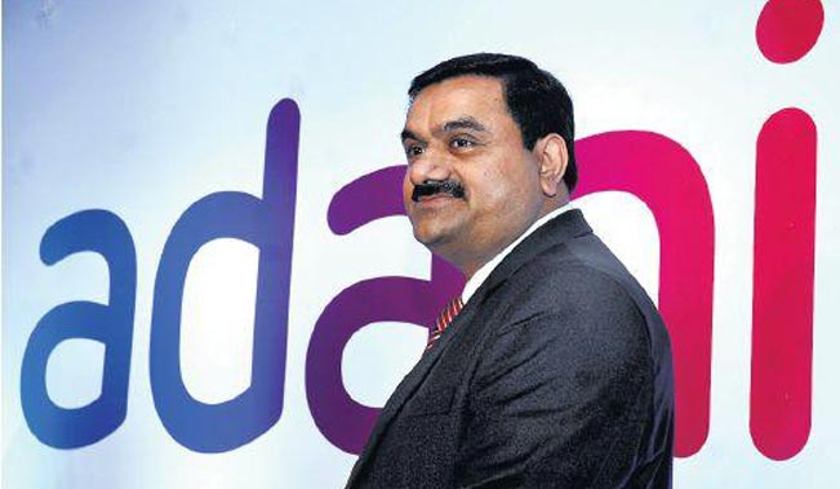

Gautam Adani, who was not only India's but Asia's richest person till a few days ago, has been facing a difficult phase for the last few days. After the Hindenburg report came out, Gautam Adani's net worth decreased rapidly and the shares of his business house companies are continuously declining. The situation became such that Adani Enterprises FPO, the flagship company of the Adani Group, had to withdraw its huge FPO even after being fully subscribed. Now Gautam Adani himself has told about why he was forced to take such a decision.

"For me, the interest of my investors is paramount and everything else is after that," Adani said in a message to shareholders about the withdrawal of a record Rs 20,000 crore FPO. For this reason, we withdrew the FPO to protect investors from further losses.

This offer of Adani Enterprises was the largest FPO in the country so far. Just before the FPO opened, American short-seller firm Hindenburg released a report and levelled several allegations against the Adani Group. Since then, the decline of Adani Group shares has not stopped. However, taking the FPO, it was fully subscribed by the last day. For the FPO, the group had fixed a price band of Rs 3112 to Rs 3276. On the other hand, shares of Adani Enterprises closed at Rs 2,128.70 on Wednesday, down 28.45 per cent from its previous close.

Adani expressed his gratitude to his investors and said that whatever they have achieved so far is due to the investors. "In my journey of over four decades as an entrepreneur, I have received overwhelming support from all stakeholders, especially investors. It is important to say that whatever I have achieved in life so far is due to the trust of co-investors. All my success is because of him. That is why for me, the interest of investors is paramount.

Gautam Adani said in a video message, "The foundation of our company is solid. Our balance sheet is healthy and our assets are fantastic. Our EBITDA levels and cash flow are strong. We have a great record of meeting liabilities. We will continue to focus on value creation for the long term and growth requirements will be met from internal resources.